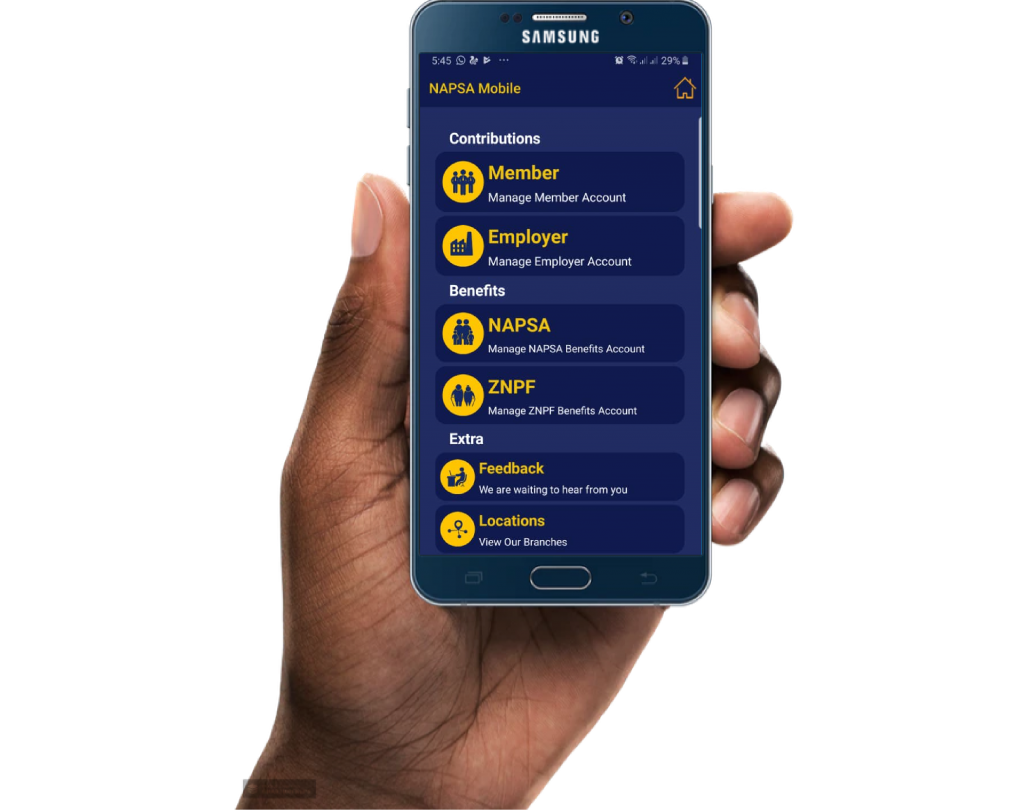

About Contributions

What are contributions

In the context of the National Pension Scheme Authority (NAPSA) in Zambia, contributions refer to the mandatory payments made by both employers and employees to fund the national pension scheme. These contributions are designed to provide financial security to workers upon retirement, in cases of invalidity, or to their survivors in the event of death.

NAPSA contributions build a secure financial foundation for your future, ensuring you have income during retirement and providing protection for you and your family in case of disability or death. The scheme operates on a principle of shared responsibility, with both employers and employees contributing to build a sustainable pension system.

-

Formal Sector

-

Informal Sector (ECIS)